About Us |

|

C.B. "Doc" Faulkner | Certified Financial Planner, CFP®

C.B. "Doc" Faulkner has been in the Financial Services Industry for 40+ Years and is currently an Independent Financial Advisor based in Charlotte, North Carolina. In 1988 Mr. Faulkner earned the prestigious professional designation of Board-Certified Financial Planner (CFP) and formerly held a series 7 Securities License. He worked for several years with a major securities firm in St. Louis, Missouri and did financial planning AND MUTUAL FUNDS WITH Waddell and Reed Financial Planning Firm.

"Doc" Faulkner formerly worked in the healthcare industry as a Registered Respiratory Therapist and held two positions as Director of Respiratory Care at two major hospitals in St. Louis, Missouri during the 1970s. He started his career in financial services with The Equitable Life Assurance Society of The United States in 1981 for several years as a top Life Insurance producer and then worked for Mutual of Omaha as a Health Insurance Producer. Financial Freedom Group (FFG) specializes in TAX FREE RETIREMENT and SAFE MONEY SOLUTIONS as well RAPID DEBT ELIMINATION. Our RAPID DEBT ELIMINATION PROGRAM utilizes a Proprietary FINANCIAL GPS to help our clients pay off a 30-year or less mortgage in 5-7 years! This program includes your MORTGAGE, STUDENT LOANS, AUTO LOANS AS WELL ANY CREDIT CARDS along with any other debt in 7-10 years saving you tens of thousands of dollars in interest. SAFE MONEY PLACES is a haven for Pre-Retirees or Retirees to PROTECT their Qualified or Non-Qualified retirement funds. This Strategy provides guaranteed safety from stock market loss with market-like returns as well as a guaranteed income stream that cannot be outlived. "Doc" Faulkner, CFP currently works with Pre-Retirees, Retirees and Young Professionals. " . Mr. Faulkner currently works with healthcare and other professionals (Physicians, Registered Nurses, and Registered Respiratory Therapists) with their retirement plans offering a unique ALTERNATIVE TO THE TRADITIONAL 401(k) and 403(b) plans that is designed to provide TAX-FREE RETIREMENT INCOME! This IRS approved plan will also help REDUCE EXCESSIVE FEES, TAXES and eliminate MARKET RISK. C.B. “Doc” Faulkner is the father of one son and two grandchildren. Mr. Faulkner is licensed in multiple states across the United States and works in-person or virtually to provide services. Call for your No-Obligation 20 Minute FREE Presentation and/or your GUARANTEED DEBT FREE ANALYSIS DATE |

|

Our Services

What We Do For Clients |

|

Asset Protection

Retirement doesn’t mean that it’s time to stop growing. Same holds true for your money. It should mean, however, that it’s time to stop taking unnecessary risk.

We specialize in helping retirees protect their retirement assets while continuing to move forward. |

Family Legacy Planning

Many of our clients want to leave a legacy for their children and grandchildren and are shocked to learn how easy it is to double, even triple their inheritance – TAX-FREE AND GUARANTEED!

We also work with our clients and help them embrace their own mortality and be prepared for the loss of a spouse and the income burdens this can often create. |

|

Extended Care Solutions

Long-term care/extended care costs have gone up substantially in the last 10 years. Unfortunately, the statistics are not in our favor, a plan to address these costs should be included in every retirement strategy.

The good news is we work with hybrid insurance plans that leverage your dollar in case you need it for extended care, but remain 100% accessible for withdrawal if you don’t. |

Retirement Income

Creating an income plan to last throughout retirement is perhaps the single most important challenge retirees will face. It’s very likely to spend 30 years or more living in retirement without earned income.

We create a customized retirement income plan, encompassing all sources of income, for each one of our clients and no two plans are exactly alike. Let us get to work on a plan for you. |

We Love To Meet New People!

Retirement Ready Calculator

Your Retirement Readiness Calculator, Click Here to find out if you're ready!

Retirement Journey Video, Click Here

Retirement Journey Video, Click Here

How we help you on your Retirement Journey

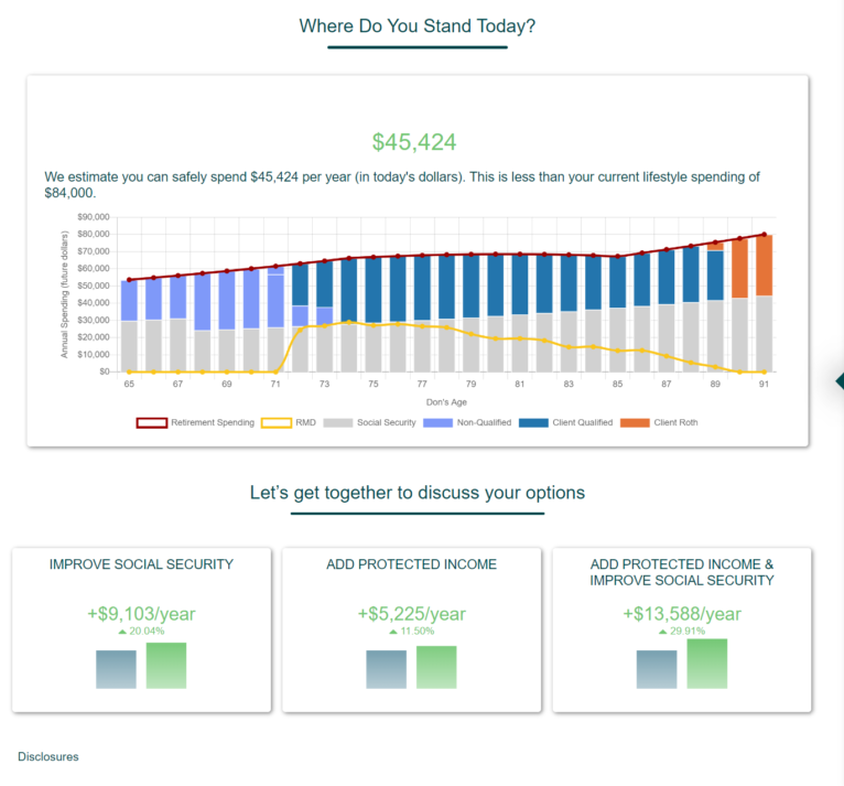

We Perform Interactive Planning

We Plan with You (Co-Planning)

Getting the answers to questions like “How much can I spend in retirement?” can now be done in

real-time, collaborative planning along with you. Our Program leverages proprietary algorithms to

run thousands of simulations with lightning speed, so we can immediately show you the effect of

changing key variables in your retirement plan. We will not need to say to you, “We’ll get back to

you in a few days”.

We Impact Guaranteed Income Streams

We Protect You Against Longevity Risk

The impact of when one takes Social Security is demonstrated instantly with our Proprietary

Retirement Planning Software System. Other guaranteed income streams like pension and annuity

benefits are simple to include. Current Annuity pricing is integrated directly into the tool,

unlike any other software. Our Retirement Planning Software System illustrates the findings of our

research with leading universities – there is a balanced approach to blending investments with

guaranteed income to improve retirement outcomes.

WE Move our Clients from Uncertainty to Confidence

We Help Manage Sequence of Return Risk

We show you the changes you can make to go from uncertainty to success in retirement. Our Income

Frontier graph helps to ensure our strategy is in YOUR BEST interest and not ours. As Fiduciaries

we follow the Best Interest Practices mandated by law in February 2020 by the NAIC (National

Association of Insurance Commissioners). We give you the confidence you will have the GUARANTEED

STREAM of INCOME you will need regardless of the market

outcome.

We Help You Understand the Pitfalls

By Creating a Plan for the "What ifs" Scenarios

The most careful plans for retirement can fall apart due to a multitude of risks. We use our

Proprietary Software System to stress test our proposed plan from the following:

• Long Term Care

• Early Death

• Early Employment

• Stock Market Losses

We Empower You to Know Your Best Strategy

By Optimizing Your Social Security Benefits

We have the ability to calculate your Social Security benefits at each age using your Primary

Insurance Amount or prior year wages, and if eligible, determine the best route for claiming

spousal benefits. Were you aware there are 2,728 RULES GOVERNING Social Security Benefits? We show

you the best strategy for your

particular situation with our proprietary software system.

We Perform Interactive Planning

We Plan with You (Co-Planning)

Getting the answers to questions like “How much can I spend in retirement?” can now be done in

real-time, collaborative planning along with you. Our Program leverages proprietary algorithms to

run thousands of simulations with lightning speed, so we can immediately show you the effect of

changing key variables in your retirement plan. We will not need to say to you, “We’ll get back to

you in a few days”.

We Impact Guaranteed Income Streams

We Protect You Against Longevity Risk

The impact of when one takes Social Security is demonstrated instantly with our Proprietary

Retirement Planning Software System. Other guaranteed income streams like pension and annuity

benefits are simple to include. Current Annuity pricing is integrated directly into the tool,

unlike any other software. Our Retirement Planning Software System illustrates the findings of our

research with leading universities – there is a balanced approach to blending investments with

guaranteed income to improve retirement outcomes.

WE Move our Clients from Uncertainty to Confidence

We Help Manage Sequence of Return Risk

We show you the changes you can make to go from uncertainty to success in retirement. Our Income

Frontier graph helps to ensure our strategy is in YOUR BEST interest and not ours. As Fiduciaries

we follow the Best Interest Practices mandated by law in February 2020 by the NAIC (National

Association of Insurance Commissioners). We give you the confidence you will have the GUARANTEED

STREAM of INCOME you will need regardless of the market

outcome.

We Help You Understand the Pitfalls

By Creating a Plan for the "What ifs" Scenarios

The most careful plans for retirement can fall apart due to a multitude of risks. We use our

Proprietary Software System to stress test our proposed plan from the following:

• Long Term Care

• Early Death

• Early Employment

• Stock Market Losses

We Empower You to Know Your Best Strategy

By Optimizing Your Social Security Benefits

We have the ability to calculate your Social Security benefits at each age using your Primary

Insurance Amount or prior year wages, and if eligible, determine the best route for claiming

spousal benefits. Were you aware there are 2,728 RULES GOVERNING Social Security Benefits? We show

you the best strategy for your

particular situation with our proprietary software system.

Contact Us

|

|